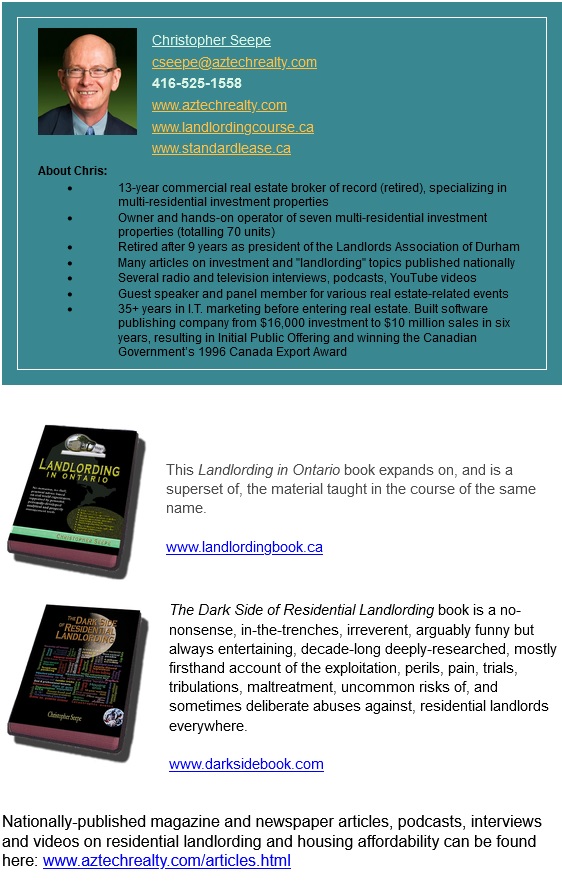

多伦多市长候选人唐炜臻:给选民克里斯托弗·西普(Christopher Seepe)的回信

5月30日

你好,克里斯托弗:

你是一个非常好的人,可以和你讨论可负担房屋问题,你很善于分析,务实,知识渊博,有远见。我的专长是找到像你这样的合适人选,并找到像沃伦•巴菲特这样的资金来进行投资,使商业成功运作。我并不假装我什么都知道,能够为每个问题和议题提供解决方案。我知道如何领导人和社会,并找到资金来投资,使企业和政府运作。

我认为你对可负担房屋的想法和解决方案会比我的好得多,也比那些参选的其他人更好。

至于埃隆•马斯克和杰夫•贝佐斯,他们是最成功的商人和投资者之一。如果你能让他们为我们的人民工作,每个人都能负担得起住房和食物。他们能力强,胜任工作,比那些只会说空话的人更好。

正如你所指出的,你阅读了关于住房可负担性辩论的媒体报道,对这个世界级城市的潜在政治领导人提出的住房可负担性解决方案感到沮丧。还有谁会呢?我理解的是你和你所说的。

如果有人让我提供可负担房屋的解决方案,我会去找像你和专家这样的人提供建议,而不是自己独自研究并找出解决方案。

我认为联邦政府和省级政府也在努力提供可负担房屋的资金支持,市政府也在为此努力。我的解决方案是利用多伦多的资源赚更多的钱,为可负担房屋提供更多资金。建造更多房屋,扩大现有房屋,并提供像移动房屋等廉价房屋。

诚挚地致意

唐炜臻

2023年5月30日

你好,炜臻:

你对各种人的问题和性格做了很多笼统的陈述,却没有提出任何计划或具体行动方案来解决这些各种关切。

将多伦多市治理得像一家首席执行官一样是非常狭隘的。政府必须解决许多私营企业和盈利实体不必处理的问题。仅仅基于财务可行性做出“仅仅商业决策”将不符合最多市民的最大利益。

你对埃隆•马斯克和杰夫•贝佐斯的引用也带有污点。他们过去都有一些丑闻,这些丑闻并没有为周围的人服务。我最近看了一部关于杰夫•贝佐斯的纪录片,内容并不特别令人赞许。埃隆•马斯克也有一系列有争议的时刻和丑闻。

沃伦•巴菲特可能是一个更好的榜样,但他对政治没有兴趣,几乎可以肯定他会同意首席执行官或成功企业家的技能组合不一定与政治工作相契合。

你也没有提到如何解决住房不可负担性的问题,这正是我写信给你的主要原因。

如果你愿意,我仍然很乐意与你讨论,但我认为你的平台与住房供应不足和负担能力的重大问题不一致。

除非我得到你的不同回复,否则我会认为目前讨论对你没有用处。尽管如此,观点、意见交流等的互换是使民主伟大的一部分……在它发挥作用时。我真诚感谢你与我分享你的想法。

祝好,

克里斯托弗

2023年5月30日

5月29日

亲爱的克里斯托弗·西普先生:

非常感谢您的电子邮件。我同意您在电子邮件中所指出的问题,这是您完全正确的观点:

政府…

• 与房屋价值存在根本利益冲突

• 无法负担得起可负担房屋

• 没有解决住房负担能力所需的资源

• 不理解住房负担的复杂性。

大多数政治家并不知道他们在谈论什么,他们只是虚伪的表演艺术家和媒体宠儿。 他们无法找到问题,也无法找到解决方案。我读到了六位主要候选人关于住房负担能力的辩论的媒体报道,对于这些潜在的政治领导人提出的解决方案感到失望,他们是世界一流城市的潜在领导人。

正如您所说,存在解决方案,但它们需要创新思维和政治勇气。这还需要政治家和公务员政策制定者与唯一具备解决住房危机所需资源、专业知识、推动力和创业勇气的市场进行接触、倾听和合作,而这个市场不是政府、公共住房、”研究”机构、租户、倡导者或媒体。

住房不可负担,食品也不可负担,政府也不可负担,政客也不可负担,它们都需要金钱。如果人们没有钱,没有任何东西是可负担的。如果我能当选并领导政府,一切都将是可负担的,因为我是一个能够赚钱、为多伦多居民创造财富并支付所有成本的金融家和企业家。

多伦多是一座伟大的城市,拥有丰富的资源来创造财富,它需要的只是一个真正的领导者,一个像您在电子邮件中所说的金融商人。

多伦多人需要投票支持那些能够成为多伦多首席执行官的候选人,比如埃隆·马斯克或杰夫·贝佐斯,他们经营着一家公司并赚钱,会照顾股东和员工,创造财富,而不会像政治家那样向股东和员工征税。唐炜臻就是这样一个人,他是一位金融家和企业家。 我很愿意与您预约,并就可负担住房问题进行讨论,改变治理的方向。

祝好!

唐炜臻

2023年5月29日

亲爱的炜臻(多伦多市长候选人):

我看到六位领先候选人在媒体上关于住房可负担性的辩论报道,对于这个世界级城市的潜在政治领导者提出的解决方案感到沮丧。

政府…

• 在住房价值上存在根本利益冲突

• 无力负担可负担的住房

• 没有足够的资源来解决住房可负担性问题

• 不了解住房可负担性的复杂性

解释如下:

政府在住房可负担性问题上存在根本利益冲突。大部分省级和市级财政收入都是基于房地产价值(如房产税、土地转让税、可收回资本成本津贴等)。如果出租物业成本增加,净经营收入就会减少。将净经营收入除以“资本化率”就能确定基准租赁物业价值。简单来说,净经营收入每增加一美元,房地产投资物业就会损失20美元的房地产价值(以5%的资本化率计算)。增加税费会减少净经营收入,从而降低房地产价值,进而减少政府收入。通过进一步增加房产税来弥补赤字,又会进一步降低房地产价值,从而进一步减少政府收入。这是一个无法取胜的恶性循环。我可以给你提供每一美元租金在任何中小型租赁物业中的分配情况的详细数据。

没有银行会为可负担房屋提供资金支持,不是因为它们“贪婪”(尽管确实有一些这样的情况),而是因为贷款金额与租赁物业的收入能力之间的差距“危险地”过窄,尤其是如果房地产价值下降。这种情况正是2008-2009年全球经济崩溃的确切情况。

加拿大住房抵押保险公司(CMHC)提供抵押贷款保险保护。上个月(2023年04月18日),CMHC宣布可负担房屋项目的保险覆盖率将是标准住房按揭融资的两倍。他们的理由是“审慎风险分析”。

根据CMHC的数据,加拿大49%的出租房屋是由“非法人化个体”拥有的。加拿大住房市场的一半归“妈妈和爸爸”、退休人员、医生、律师、牙医等个体专业人士所有,他们都没有任何形式的退休保障计划。约有1,350,000人在个人纳税申报表上报告他们有租金收入。如果没有这些小型投资者,大多数租户将无处可住。

政府无力负担可负担房屋。 加拿大98.5%的住房是由私营部门建造和支付的,公共部门住房只占1.5%。

联邦政府用于建造、维修和提供住房补贴的780亿加元只能在加拿大全境每年建造大约29,250个新住房单位,这还是假设成本不增加的情况下。

安大略省目前急需65万个住房单位,加拿大急需150万个住房单位。加拿大的人均住房数量是G7国家中最低的。

安大略省的4000亿加元债务是世界上最大的次国家债务,超过了包括俄罗斯在内的168个国家。

安大略省人每小时支付超过900万加元的利息。

对租赁和购买住房增加任何税收、费用、许可证、关税或征收费用都会使住房变得更不可负担。将房产税与通胀率挂钩将是灾难性的。租金控制环境已经使满足无法控制的大规模快速增长的资本和运营成本变得几乎不可能,而收入不仅被束缚,而且被限制在最高2.5%,而通货膨胀率则是6%或更高。

所谓的“金融化住房”是一个“红鱼”,如果个人必须支付房屋的全部购买价格,贫富差距将会极大。抵押贷款融资和证券化(即“金融化”)显著有助于减少富人与穷人之间的贫富差距,为传统上得不到服务的人群提供住房机会,促进个人经济自主权和提高生活质量。

所有领先市长候选人提出的建议都是重新使用早已失败的住房政策和战略,这些政策和战略导致了当前的住房危机。这些提议的解决方案都是针对需求而不是供应,针对住房危机的症状而不是根本原因。

大多数人都会同意,在一个集市上,如果有三个苹果,七个人想要,那么这三个苹果的价格肯定比同样集市上只有三个人想要的七个苹果的价格高。苹果本身并没有变化,将苹果种植和运送到集市并提供购买的成本也没有变化。唯一改变的是需求。如果每个租户都有三个选择,租赁物业将更具可负担性。如果每个买家都有三个选择,住房价格将更具优势。

存在解决方案,但需要创新思维和政治勇气。这还需要政治家和公务员制定政策时与市场合作,倾听市场并与市场合作,因为市场是唯一具备解决住房危机所需资源、专业知识、推动力和创业勇气的力量,而这不是政府、公共住房、研究机构、租户、倡导者或媒体。

如果你愿意讨论住房不可负担和不可获得性危机的现实世界、实际解决方案的短期和长期措施,欢迎随时与我联系。

克里斯托弗·西普

租赁住房提供者

2023年5月29日

English

Toronto Mayoral Candidate Tang Weizhen: Reply to Christopher Seepe

May 30, 2023

Hi, Chris,

You are a very good person to talk to about the affordable housing issue and you are very analytic and practical and knowledgeable,visionary. My expertise is to find right person like you and find money like Warren Buffet to invest and make business works. I am not pretending that I know everything and could provide solutions every problem and issue. I know how to lead people and the society and find money to invest and make business and government work.

I think your ideas and solutions to affordable housing would be much better than mine and those others who are running the election.

In terms of Elon Musk and Jeff Bezos, who are one of those most successful businessmen and investors. If you find them to work for our people, everybody would be able to afford housing and food on the table. They are competent and capable and better than whose just talk and

As you point out, you read the media coverage of the housing affordability debates among the six leading candidates and was dismayed to see the types of solutions to housing affordability being proffered by the potential political leaders of a world class city. Who else would? What I understand is you and what you said.

If people ask me to provide solutions to affordable housing, I would go to people like you and experts to give me proposals, instead of doing my own research and figuring out a solution by myself.

I think that The FED and provincial government are also working to provide funding for affordable housing and the city also works on it. My solution is to use Toronto resources to make more money and provide more funding to affordable housing. To build more houses, expand existing houses and provide cheap houses like mobile houses etc.

Sincerely yours

Weizhen Tang

May 29, 2023

Hello Weizhen,

You make a lot of sweeping statements about the issues and characterizations of all kinds of people to blame but you did not offer any plan or specific action items to address these various concerns.

Running the City of Toronto like a CEO is extremely narrow in scope. There are many issues that government must address that private enterprise and for-profit entities do not have to deal with. Making “business-only” decisions based on financial viability alone would not serve the best interests of the greatest number of citizens.

Your allusions to Elon Musk and Jeff Bezos as models that mayors should aspire to is also tainted. Both have scandals in their past that didn’t serve the interests of those around them. I recently watched a documentary on Jeff Bezos and it was not particularly flattering. Elon Musk has a raft of controversial moments and scandals.

Warren Buffet might be a better model but he would have no interest in politics and almost certainly would agree that the skill set of a CEO or successful entrepreneur would not necessarily map well with.

You also didn’t make a single statement about how you would resolve housing unaffordability, which was the principal reason I wrote to you.

I’m still happy to have a discussion with you if you wish but I don’t think your platform is aligned with the over-arching issues of housing unavailability and unaffordability.

Unless I hear from you to the contrary, I’ll assume that a discussion wouldn’t be useful to you at this juncture. Notwithstanding that, the exchange of ideas, viewpoints, opinions etc. is what makes a democracy great … when it works. I sincerely appreciate you sharing your ideas with me.

Regards,

Chris

May 30, 2023

May 29, 2023

Dear Mr. Christopher Seepe,

May 29, 2023

Dear Weizhen, (Toronto Mayoral Candidate)

I read the media coverage of the housing affordability debates among the six leading candidates and was dismayed to see the types of solutions to housing affordability being proffered by the potential political leaders of a world class city.

Government …

• Has a fundamental conflict of interest with housing values

• Can’t afford affordable housing

• Doesn’t have the resources to solve housing affordability

• Doesn’t understand the complexities of housing affordability

Explanations:

Government has a fundamental conflict of interest with housing affordability. Most provincial and municipal revenues are based on the value of real estate, (property taxes, land transfer tax, recoverable capital cost allowance, etc.). If a rental property’s cost increases, its net operating income decreases (NOI). Dividing NOI by the “cap rate” defines baseline rental property value. To keep it simple, for every one-dollar increase in NOI, a real estate investment property loses $20 in property value (at a 5% capitalization rate). Adding a tax or fee decreases NOI which decreases property value, which decreases government income. Making up the shortfall by further increasing property tax further decreases property value, which further decreases government revenue. It’s a non-win, vicious circle. I can send you a breakdown of where each $1.00 of rent goes in any small-to-medium rental property.

No banks will fund affordable housing … not because they are “greedy” (although there’s some of that) but because the spread between the amount of money loaned versus a rental property’s ability to generate enough income to pay back the loan (with interest) is “dangerously” too narrow, especially if property values drop. This situation was the exact situation behind the world-wide economic collapse in 2008-2009.

CMHC offers mortgage insurance protection. Last month (2023 04 18), CMHC announced that coverage for affordable housing projects will be double that of standard housing mortgage financing. Their reason … “prudent risk analysis.”

According to CMHC, 49% of all rental housing in Canada is owned by “unincorporated individuals.” HALF of Canada’s housing market is owned by “moms and pops,” retirees, individual professionals like doctors, lawyers, dentists, etc. of which none have any kind of guaranteed retirement plan. About 1,350,000 people reported on their personal tax returns that they receive some form of rental income. Without these small investors, where would most tenants live?

Government can’t afford affordable housing.

98.5% of all the housing built in Canada was built and paid for by the private sector. Public sector housing built only 1.5%.

Federal government’s $78 billion allocation to build, repair and provide subsidies for housing would only result in perhaps 29,250 new housing units … per year … for all of Canada … assuming no increases in costs

Ontario needs 650,000 units immediately. Canada needs 1,500,000 housing units immediately. Canada has the lowest housing per capita of all the G7 nations.

Ontario’s $400 billion debt is the largest sub-national debt in the world—larger than 168 countries, including Russia.

Ontarians pay over $9 million per hour in interest.

Any tax, fee, license, tariff, levy added to rental and purchase housing makes housing less affordable. Linking property tax to the inflation rate would be catastrophic. The rent-controlled environment makes it already near-impossible to meet uncontrolled, massively and rapidly increasing capital and operating costs while the income is not only strangled but capped at a maximum of 2.5% but inflation rates are 6% or more.

The supposed “financialization of housing” is a “red herring.” The wealth gap would be unfathomably wide if individuals had to come up with the full purchase price of a home. The availability of mortgage financing and securitization, that is “financialization,” contributes significantly to reducing the wealth gap between the haves and the have-nots. It provides access to housing for traditionally under-served populations and fosters individual economic empowerment and improved quality of life.

All the proposals made by the leading mayoral candidates are re-purposing long-since-failed housing policies and strategies that led us to this current housing crisis. The proposed solutions are all focused on demand rather than supply, and on housing crisis symptoms, not causes.

Most everyone would agree that three apples available in a bazaar that seven people want will cost a lot more than seven apples in the same bazaar wanted by only three people. The apples didn’t change. The cost to grow and deliver the apples to the bazaar and then make them available for purchase didn’t change. The only thing that changed was the demand. A rental property would be more affordable if every tenant had three to choose from. A home would be priced advantageously for buyers if every buyer had three to choose from.

There are solutions but they require out-of-the-box thinking and political courage. It also requires politicians and civil servant policy makers to engage, listen to, and co-operate with the only market with the resources, expertise, drive and entrepreneurial courage to solve the housing crisis, and that isn’t government, public housing, “research” agencies, tenants, advocates, or the media.

Please feel free to contact me if you’d like to discuss real world, in-the-trenches, short- and longer-term solutions to the housing unaffordability and unavailability pandemic.

Christopher Seepe

Rental Housing Provider

May 29, 2023